With the unpredictability of the last few years, it’s more important than ever for businesses to improve their logistics and manage their processes. Everything from the customer experience to the order processing system needs to work optimally to help your business recover and grow. One area that can be improved and optimized is your order to cash cycle.

Order to cash, also known as O2C or OTC, is an important part of your business’s cash cycle. It drives the partnership between vendors, suppliers, and buyers, and impacts your customer relationship and inventory management processes. In this article, we’ll talk about what order to cash means, the steps in the process, and how you can standardize and improve your O2C cycle.

What Is the Order to Cash Process?

Order to cash is a crucial business process that spans the entirety of your order processing system and tracks the movement of goods and money from the moment a customer places an order with your business to the moment you clear their payment. Many different steps in the process require your time and attention, and the cycle continues past what many people might assume is the natural end.

O2C defines your company’s success with accounts receivables and with your customers. You can track metrics and collect data throughout the process, which you can then analyze to help you identify areas of improvement or optimization within your organization.

Why Is O2C Important?

There are many reasons why it’s important to invest time into tracking your order to cash cycle. O2C affects several parts of your business, from labor to inventory to supply chain management. When there are bottlenecks or slowdowns in your processes and orders, you need to be able to identify and track down which steps are responsible for holding back revenue growth.

A strong order to cash process also builds reliability and efficiency in your organization. Your customers trust your company more when they know what to expect, and your teams can go through workflows more effectively with clear steps and processes in place. In addition to improving customer experience, order to cash flow helps companies avoid spending their time on undue payments and invoices, allowing analysts to focus on boosting commercial growth and controlling risks.

The 8 Steps of the Order to Cash Process

While many people might think that the order to cash process ends once payment is collected, it doesn’t. There are eight steps in the order to cash process, and each one is important to the flow of the entire cycle. Without optimization and improvement in each of the following areas within the order to cash process, your organization won’t be able to function at the highest level.

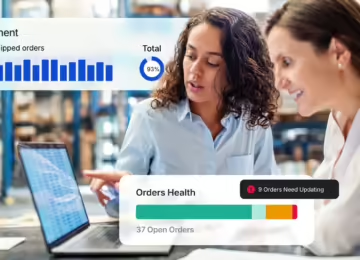

Step 1: Order Management

Order management begins when a customer places an order with a supplier or vendor — in this case, your company. Once an order is confirmed, your business is responsible for managing every part of that order, including:

- Efficient order entry

- Notifying key personnel

- Emailing sales or order fulfillment departments

- Ecommerce platforms

Automation can help keep the order to cash process moving with automatic notifications and messages that keep people and teams updated as needed once an order is placed.

Step 2: Credit Management

The next step in O2C is managing buyer credit. When you spend time doing this at the beginning of the process, you can save time and reduce issues that could arise when customer payments are due. New customers need to be approved in orders where credit is applicable to avoid problems. Many systems have automated credit approval processes built in to help streamline this step.

Step 3: Order Fulfillment

The next step in the O2C cycle is order fulfillment. This step ties heavily to inventory management — you never want to accept orders you can’t fulfill, as this can upset customers, damage communication, and create a bad relationship with your buyers. Automated inventory management systems can help you track stock in real time to help you avoid accepting orders that you can’t fulfill.

Step 4: Order Shipping

The next step in the cycle is order shipment and logistics. You need to have the tools and capabilities to plan shipments with carriers, provide your customers with accurate timelines for delivery, and organize schedules and performance standards so that your shipments are delivered without a hitch.

Step 5: Customer Invoicing

Incorrect or fraudulent invoicing is a big concern and can lead to more significant issues like cash flow problems. Ensuring that you send out accurate invoices on time is essential in O2C processes. Verify each invoice and the pricing of each line item, and utilize three-way matching to help you avoid invoicing inaccuracies.

Step 6: Accounts Receivable

The next step is accounts receivable, where you ensure that payments are received. No one likes having to track down late payments, so it’s important to do everything you can to remind customers when a payment is due. Automated reminders and invoice verification tools help reduce issues and ensure that you receive payments on time.

Step 7: Payment Collections and Reconciliation

Just as sending out payment reminders is important, it’s crucial to mark invoices as paid once the payment comes in. After all, you don’t want to remind a customer about an invoice they’ve already paid. Payment collection and reconciliation reduces friction and bolsters customer satisfaction, and keeps your bookkeeping up to date.

Step 8: O2C Reporting

While you might think that the O2C cycle is over once payment comes in, there is still one step left in your order to cash process — creating reports and managing the data you collected in the first seven steps.

Tools like ERP systems, CRM platforms, and order management systems can help you collect and manage data during the order to cash process. Without data management tools to help you analyze this information, you won’t be able to tell where your business can improve the cycle or if a single area is responsible for slowdowns or inefficiencies in your organization. Analyzing this information shows you what you can streamline and where you can optimize your processes.

Order to Cash Challenges

While the order to cash process steps are standard, organizations face some challenges in their O2C processes. These issues are often responsible for slowdowns, bottlenecks, or inefficiencies in the process:

- Too much or not enough order diversity

- Inaccurate sales orders

- Dissatisfied and unhappy customers

- Late, missing, or incorrect payments

- Inefficient manual invoicing processes

- Handling multiple types of payments

- Ineffective and error-prone collection processes

- Inefficient dispute resolutions for invoicing discrepancies

- Information silos and lackluster communication between teams or customers

- High resource costs and limited working capital

Tips To Improve the Order to Cash Process

To have a truly successful order to cash process, you need to have technologies, systems, or platforms in place to manage most of the heavy lifting in the cycle. When a business relies on manual O2C processes, there is a much higher risk of human error, slowdowns in the process, and inefficient use of time.

Thankfully, you can take many actionable steps to help automate the order to cash process. The following tips are designed to help you avoid ineffective manual labor while managing your order to cash process.

Standardize the Process

Standardizing the process of O2C helps create consistency and avoid missing steps in the process. Creating playbooks or guidebooks for staff can help new employees keep up, and ensures that every team member has the same goals to keep the O2C process moving smoothly.

Optimize Orders With Automation

Automation makes things easier, and you rely less heavily on manual labor when you can leverage automation to optimize your order to cash processes. This helps organizations avoid mistakes from human error and instead find the systems and tools that can more effectively (and accurately) move orders through the process. Many tools have built-in automation for each step in the O2C cycle, making them great investments for businesses that want to grow or improve their O2C flow.

Monitor O2C To Find Opportunities to Improve

As mentioned above, the final step of the O2C process is one of the most important — the step where you look back at the process and use the data you collected to guide future decisions. Technology and platforms like your ERP can help you track, collect, and organize this data in one place. You can then compile the data into reports that your company’s leadership team can use to make better decisions about areas of improvement within the O2C cycle.

Implement Self Service

Another way to help take pressure off your teams is to invest in self-service tools. When you put pieces of the O2C cycle (like accounts payable) into customers’ hands, your internal teams don’t have to spend as much time sending over copies of invoices or answering simple questions. A self-service portal makes it easy for your customers to track their orders, make payments, and get assistance 24/7. It also makes communication between vendors and buyers easier, as your customers have a clear avenue for reaching out to your company at any time.

Experience Fewer Supply Chain Disruptions and Greater Order Fulfillment With Anvyl

Improving your business’s internal and external processes is essential to growth. A business can’t scale with inefficient processes, so it’s vital to know how to optimize and improve existing workflows. Order to cash is a significant part of your organization and affects your accounts receivable, shipping, finance, and accounting teams. When you can improve your O2C process, you can improve many areas of your business at once.

Anvyl can help you gather metrics within your order to cash process, helping you streamline your workflows to create a better, more efficient order processing system. If you’re interested in learning more about how Anvyl can improve your supplier relationships and optimize your supply chain management, request a demo and explore the platform for yourself today!