Understanding the vital connections between operations, vendor relationships, and purchase order (PO) financing is crucial for supply chain success. Working capital plays a pivotal role in ensuring these elements function seamlessly together.

In this blog, we will focus on why operations and financing need to work together and highlight the importance of effective PO financing for your business.

The Challenge of Financing

Imagine your brand has just landed a significant order, marking a major growth milestone. As excitement builds, so does the need for essential supplies. This is where the challenge of financing becomes evident.

- Upfront Costs: Fulfilling a new order requires purchasing raw materials, increasing production capacity, and possibly investing in additional labor and logistics. These activities demand substantial upfront capital.

- Supply Chain Delays: Without adequate funding, you might face delays in procuring essential supplies, leading to production slowdowns or halts. This disruption can cascade through the supply chain, resulting in missed deadlines, dissatisfied customers, and strained vendor relationships.

- Higher Costs: Inadequate financing can hinder your ability to take advantage of bulk-purchase discounts from suppliers, leading to higher costs per unit.

- Limited Negotiation Power: Insufficient funds can limit your ability to negotiate favorable payment terms, further straining your cash flow.

Supply Chain Complexities

Managing the order-to-warehouse process is a critical aspect of supply chain operations, however, several challenges can disrupt this flow:

- Inventory Management: Inadequate financing can lead to insufficient inventory levels, causing stockouts and production delays.

- Logistics Coordination: Delays in payment can disrupt logistics operations, affecting transportation and warehousing schedules.

- Vendor Reliability: Without timely payments, vendors may become unreliable, impacting the consistent supply of raw materials and components.

- Production Efficiency: Cash flow issues can hinder the ability to maintain or upgrade production facilities, affecting overall efficiency and output quality.

- Customer Satisfaction: Disruptions in the supply chain can lead to delays in fulfilling customer orders, negatively impacting customer satisfaction and brand reputation.

Effective financing options empower brands to navigate these complexities more easily, ensuring continuous operations and growth.

Working Capital Support for Your Operations

Sufficient working capital is essential to cover expenses related to production, procurement, and order fulfillment. This ensures that brands have the necessary funds to manage day-to-day operations and maintain a steady flow of goods and services.

Timely Payment to Vendors

Reliable financing allows companies to pay their vendors promptly. This not only strengthens vendor relationships but also positions your brand as a reliable partner in the supply chain. Strong vendor relationships are crucial for maintaining a steady supply of goods and services, built on trust and mutual benefit.

Risk Mitigation

Access to financing mitigates the risk of cash flow gaps. Brands can confidently fulfill large orders knowing they have financial support. This reduces the risk of production delays, stockouts, or missed opportunities, ensuring that operations run smoothly and efficiently.

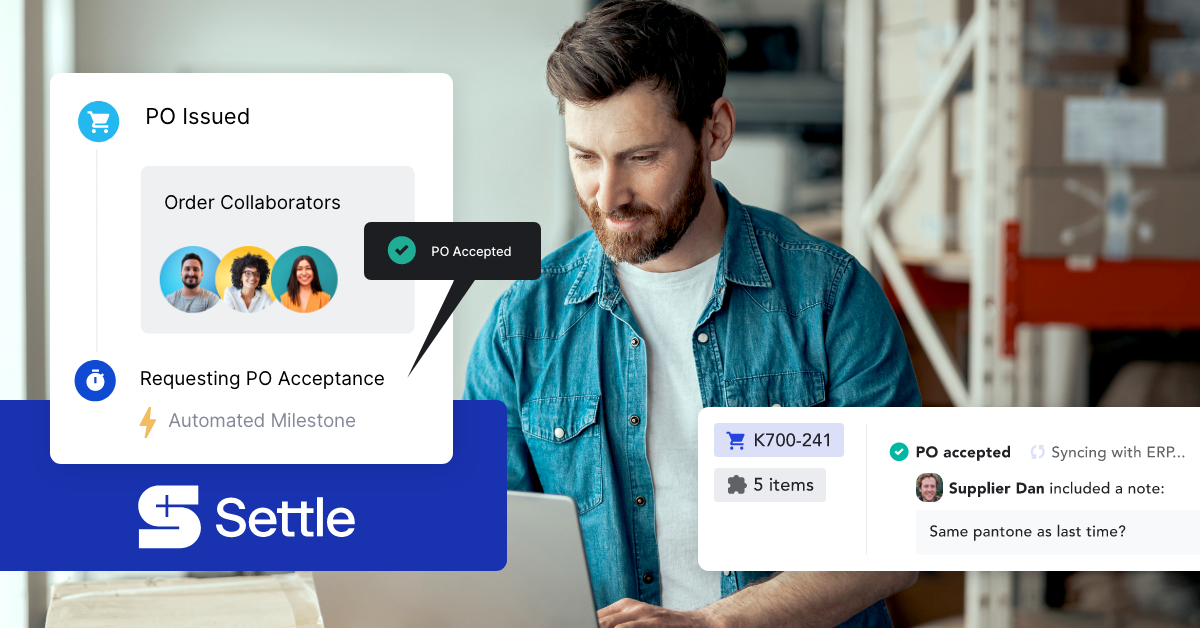

Streamlined Processes

Integrating financing solutions into your supply chain platform allows you to manage invoices, payments, and financing efficiently, all in one place. This streamlined approach enhances the overall experience and simplifies financial management, enabling you to focus on growing your business.

Settle’s Working Capital Solutions

Settle offers tailored Working Capital designed to meet the specific needs of businesses like yours. With flexible financing options, you can access the funds you need to optimize your supply chain operations without the stress of cash flow constraints.

The Symbiosis of Operations and Financing

Why is it important for operations and financing to work together? When these elements are in sync, brands can handle supply chain demands more effectively, backed by a reliable support system. This collaboration ensures that your business can scale and meet increasing demands without financial constraints.

The partnership between your supply chain operations, effective financing solutions, and your vendors goes beyond basic collaboration – it’s about creating a strategy that supports your brand’s growth.

Together, we help ensure smooth operations, strong vendor partnerships, and significant opportunities to scale.

About Settle

Settle propels the growth of CPG brands by simplifying cash flow management. Through an integrated platform, Settle empowers consumer goods and e-commerce brands to elevate their financial operations with seamless vendor payments, purchase order 3-way matching, invoice management, and transparent financing to Settle Now. Pay Later through Settle Working Capital. Settle proudly serves hundreds of high-growth CPG brands, including Branch,Soft Services, Dagne Dover, HigherDOSE, and Olipop.

Visit settle.com to learn more.